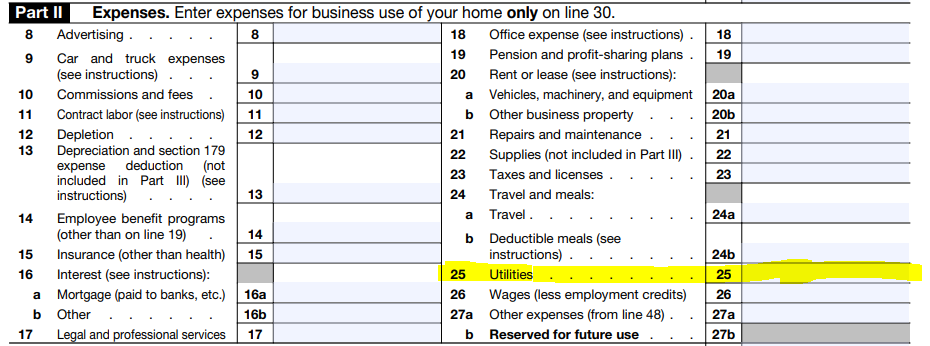

Line 25 on Schedule C of the tax form relates to “Utilities,” which refers to the cost of utilities incurred while operating your business.

Utilities expenses that you may be able to deduct on Line 25 include:

- Electricity: This includes the cost of electricity used in your business premises.

- Gas: This includes the cost of gas used in your business premises, such as for heating or cooking.

- Water: This includes the cost of water used in your business premises.

- Internet and phone service: This includes the cost of internet and phone services used in your business.

It’s important to note that there are certain requirements and limitations associated with deducting utilities expenses. For example, the expenses must be ordinary and necessary for your business, and you must keep accurate records of the expenses, including receipts, invoices, and other documentation.

If you have any questions about how to report utilities expenses on your tax return, it’s a good idea to consult with a tax professional or accountant.