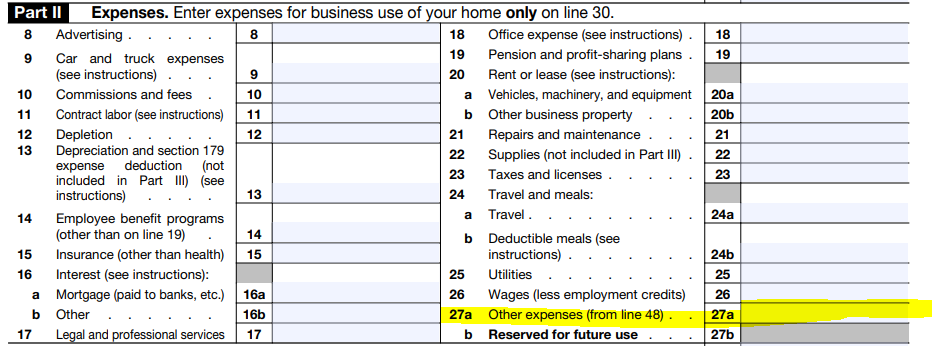

Line 27a on the Schedule C tax form relates to “Other Expenses,” which refers to any business expenses that do not fall into any of the other categories on the form.

Some examples of other expenses that you may be able to deduct on Line 27a include:

- Bank fees: This includes any fees charged by banks or other financial institutions for services related to your business.

- Dues and subscriptions: This includes any dues or subscription fees paid for business-related memberships or subscriptions, such as to professional organizations or industry publications.

- Professional development expenses: This includes any expenses related to improving your skills or knowledge related to your business, such as attending conferences or taking courses.

- Advertising expenses: This includes any advertising expenses that do not fit into the specific categories listed on Schedule C, such as online advertising or social media promotions.

- Bad debts: This includes any debts owed to you by customers or clients that you are unable to collect.

It’s important to note that there are certain requirements and limitations associated with deducting other expenses. For example, the expenses must be ordinary and necessary for your business, and you must keep accurate records of the expenses, including receipts, invoices, and other documentation.

If you have any questions about how to report other expenses on your tax return, it’s a good idea to consult with a tax professional or accountant.